How do I file an Answer to a debt collection lawsuit in Georgia?

Don't make it easy for the debt collector to get a judgment against you!

If you found this post, you are probably researching how to file an answer to a debt collection lawsuit. In doing your research, you have probably found that there are many different opinions out there. Keep in mind, there are 50 different states in the U.S. and 50 different ways of doing things. The rules and procedures in one state are not necessarily similar to another. In addition, you are sure to come across people within the same state that have differing opinions about how to go about answering a debt collection lawsuit (some lawyers, some not). Just as with anything else you read online, you need to view the advice online with a certain amount of skepticism. After all, your financial future is on the line.

There are some online services that will generate documents for you and sometimes they are generally acceptable. However, if you don’t understand what the Answer is telling the court, this might simply just buy you some time. Eventually, the case will be called for trial or certain motions may be filed and you will need to know how to conduct yourself and how to back up the content of your Answer.

What are the consequences of not properly Answering a lawsuit?

Your answer might help the debt collector get a judgment against you.

You probably already know that if you don’t file an Answer at all, you are at risk of having a default judgment entered against you. However, you should also know that if you file an Answer that does not sufficiently address the issues alleged in the debt collector’s complaint, you will also be at risk of a judgment being entered against you. Worse, sometimes the Answers that people file with the courts actually help the debt collector get a judgment against them.

Generally, if the Answer that you file with the court does not deny the allegations made in the complaint and it does not assert any defenses, then the allegations made in the complaint may be deemed to be admitted. In other words, if you didn’t expressly deny it and a response of admission or denial was required, then the court can consider your response to be an admission. Finally, many Answers are filed with extra information that is not necessary and can be construed as admissions as well (discussed in detail below).

These errors can result in the debt collector filing a “Motion for Judgment on the Pleadings” in accordance with O.C.G.A. § 9-11-12(c). A Motion for Judgment on the Pleadings filed by a plaintiff debt collector is a motion that basically requests that the court go ahead and issue a judgment against you because they can prove on paper (through the complaint and your answer) that they are entitled to a judgment and there is nothing further for the court to decide. A court may or may not have a hearing on this motion and you may never get your “day in court”. (You should be copied on all filings via mail, however, such as the motion for the judgment on the pleadings, so you are at least aware of what is going on).

Some defenses can be waived if you don’t properly and timely assert them.

There are some defenses that are required to be put in your very first responsive filing (Answer) or otherwise, they are waived. If defenses are deemed to be “waived” this means that you have abandoned them and cannot assert those defenses later. I don’t want to get too deep into waivable defenses but they can be found in O.C.G.A. § 9-11-12(f).

Sometimes there are errors made that a lawyer can’t undo.

The court is not going to go easy on you just because you are representing yourself in the defense of a lawsuit. You are expected to conduct yourself as your own attorney, without legal knowledge, if you choose to do so. Sometimes, there are errors that are committed by defendants acting pro se (or representing themselves) that even a lawyer can’t undo. If you have any hesitations about representing yourself in the lawsuit, carefully consider whether it is worth it to take the risk to your financial future.

What is an Answer?

The lawsuit papers that you are served are titled either the Complaint or Statement of Claim. This is filed by the “Plaintiff.” The Complaint or Statement of Claim is considered the debt collector’s side of the story. The Answer is the response that you file with the court that gives your side of the story. The Answer is filed by the “Defendant.”

When do I file an Answer to a lawsuit?

Generally, when you are served with a debt collection lawsuit in Georgia, you have thirty days to file your response called an “Answer” with the Court. See O.C.G.A. § 9-11-12(a). If you are unsure if you have been served with a lawsuit, take a look at this article. The thirty days are calculated from the date you were served, not thirty days from the date the case was filed with the court. Sometimes, people are confused by this and erroneously believe that by the time they are served with the lawsuit, their time to answer has already passed based on the filing date indicated on the lawsuit.

Generally, if you do not file an Answer with the Court within thirty days, you are considered to be in “default“. This means you are at risk of a default judgment being entered against you. A default judgment is a judgment that is entered against you without further notice because you didn’t file an Answer. Generally, without hearing your side of the story via an Answer, the court can assume that you admit everything in the debt collector’s lawsuit filed against you and that they are entitled to a judgment against you (assuming they can properly prove the amount alleged to be owed). Without going into too much detail, there is a mechanism in which you can “open default” within 15 days of being in default by paying the court costs. In other words, you have a 45-day window after you are served to file an Answer but this requires you to know how to properly assert this and go about paying the costs.

There is also one way that the time period to file an Answer can be extended. When you are successfully served with a lawsuit, the plaintiff is required to file a document with the court generally stating the date and method of service. This document is called an “Entry of Service” or “Affidavit of Service.” This “proof of service” is supposed to be filed with the court within five business days of the service of the lawsuit taking place. As long as it is filed with the court within five business days, your Answer is still due within that thirty-day period of when you were served. However, if the proof of service is filed with the court after five business days of service, your time to file an Answer with the court is extended. See O.C.G.A. § 9-11-4(h). Instead, the thirty days start from the day the proof of service is finally filed with the court. For example, you are served on June 1st. The proof of service is not filed within five business days of June 1st. Instead, it is filed with the court on June 10th. Your thirty days to file an Answer starts on June 10th. How do you know when the proof of service is filed? Well, you can call the clerk of court and ask. This situation is typically only helpful when you need a few more days to file an Answer and you are lucky enough that the proof of service was filed late. Don’t rely on this.

Where do I go to file an Answer to a lawsuit?

You will file your Answer with the clerk of court of the specific court in which the complaint has been filed. There are three different types of courts in Georgia in which debt collection lawsuits can be filed: Magistrate Court, State Court, or Superior Court. Every county in Georgia has its own Magistrate Court and Superior Court, but not all counties have their own State Court (it’s a population-based thing). Each of these courts has its own clerk of court. The clerk of court is the office in charge of maintaining the court case files. They can help you determine the proper procedure to get your Answer filed. Keep in mind that they cannot give you any legal advice. They can only provide administrative-type assistance, however, they can be extremely helpful. If you are unsure where to go to file the answer, google the telephone number of the clerk of court for that particular court in your county and ask them where to go. A debt collection lawsuit is a civil case, as opposed to a criminal case, so you will need to go to the “civil” clerk filing window. You also have the option of mailing in your Answer but I wouldn’t risk it getting lost in the mail or not arriving on time.

In some cases, you have the option to e-file your Answer online for a fee.

Not all Magistrate Courts in Georgia have the option to e-file an Answer. You will have to either mail it to them or take it there in person. Most State and Superior Courts in Georgia have an e-filing option. In fact, some State and Superior courts mandate that you e-file documents. There is not just one e-filing system that courts use in Georgia. It depends on the county in which you live. Two of the biggest online e-filing systems for courts in Georgia include Odyssey E-file and PeachCourt. You should contact the clerk of court in your county to determine if e-filing is available in your case.

What does the Answer to a lawsuit look like?

An Answer does not have to be complicated. Don’t overthink it. There are only a few parts of the document that are required. The Magistrate Council of Georgia has a section for court forms where you can download forms to be filled out by you and filed with the court. However, be aware that some court forms contain checkboxes or extra blank areas that you should not necessarily utilize. See below regarding what you should not put in your Answer.

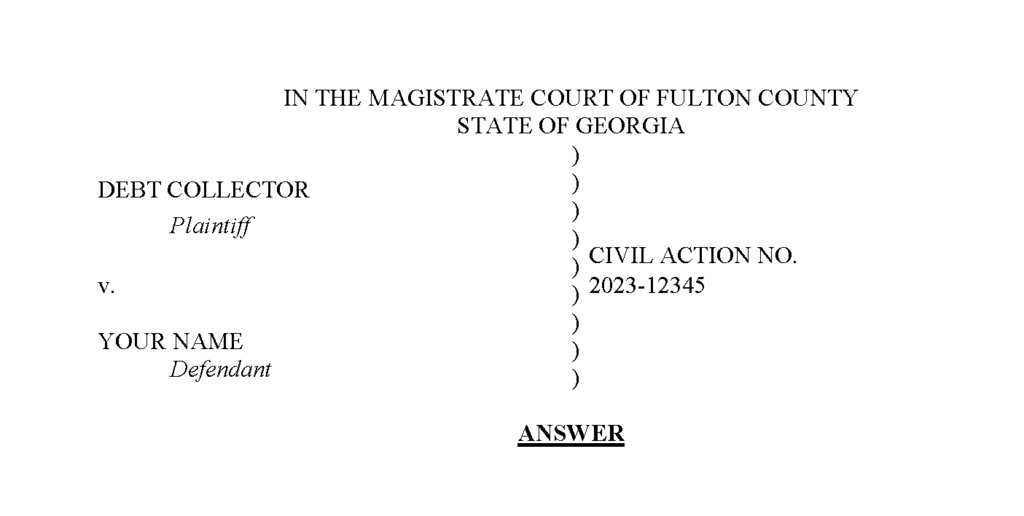

Case Caption

The top of the Answer will have the case “caption.” The case caption consists of information about the case including the specific court in which the lawsuit is filed, the parties’ names, and the case number. Without this information, the clerk may not know where to file this document. If you take a look at the lawsuit that you were served, you should see the case caption at the top of the document. Your Answer will need to include the case caption at the top. Also, you will need to title your document “Answer” so the court and the plaintiff know what it is.

What should I put in my Answer to the lawsuit?

I cannot tell you specifically what content to put in your Answer. But, I can give you some guideposts.

Affirmative Defenses

You should list any legal defenses you may have. This is where it can get complicated and you would need to have some basic knowledge of the law. For example, one legal defense is the expiration of the statute of limitations. Another might be that the debt is not owed because it was discharged in bankruptcy. Keep in mind, these are “affirmative defenses” which means it’s up to you to know what the elements of the defense are and how to prove them. See O.C.G.A. § 9-11-8(c). There are some legal defenses that must be asserted in your Answer or they are otherwise waived and you cannot assert them later in defense of the lawsuit.

Respond to the Allegations made in the Complaint or Statement of Claim

Next, respond to each of the allegations made in the plaintiff’s complaint. Typically, the allegations will be listed in a numbered format. For example, the first allegation may state that you are a resident of a specific county in the state of Georgia. If that is a true statement, you would admit it by simply writing “1. Admit.” If there are some parts of the statement that is true and some that are not, specify what is true and what is not.

What should I *NOT* put in my Answer to the lawsuit?

The Answer should not contain unnecessary information. Generally, an Answer to a lawsuit should strictly address the allegations in the plaintiff’s lawsuit, assert any defenses to the lawsuit, and assert any counterclaims, if you have any. Adding extra information may simply make it easier for the debt collector to get a judgment against you, especially if these statements are considered to be admissions. Just because there’s blank space on the Answer does not mean you need to fill it up with writing. There are a some topics you should avoid putting in your lawsuit:

- Personal circumstances that led to you falling behind on the debt (medical issues, divorce, loss of employment, etc.) Many people take the opportunity to write paragraphs in their Answers to explain hardships that led to the debt in the first place. This information is not a legal defense. Although the judge and anyone else who may read it might feel some compassion for you, the court will not consider these personal circumstances when deciding whether the debt collector has proven their case against you. In fact, by making such statements, you might be making admissions that you owe the debt and making it easier for the debt collector to prove their case and get a judgment against you.

- Attempts to settle the debt with the debt collector. Whether or not you have tried to settle the debt or the fact that you can’t get the debt collector to agree to a settlement does not matter when it comes to your Answer. The court cannot force the debt collector to agree to settle the debt with you. The court can encourage you and the debt collector to attempt to resolve the case with a settlement before it makes decisions regarding the debt collector’s entitlement to a judgment against you or your defenses against the case. In fact, some courts mandate that parties participate in mediation to try to settle the case prior to it being heard by the judge. It is also not necessary for you to indicate your willingness to attempt to settle the debt as part of your answer. Again, this statement could be construed as an admission that you owe the debt and make it easier for the debt collector to prove their case against you and obtain a judgment.

- Avoid checking Answer form boxes that say “I request a payment plan”. Some courts offer an Answer form that contains the statement “I request a payment plan” and a checkbox next to it. Just because it is there, doesn’t mean you have to check it either way.

- Do not rely solely on a statement that you don’t recognize the debt. Many people put this or some variation of this in their Answer to a debt collection lawsuit because they don’t recognize the debt buyer who is suing them. There is a difference between not recognizing the debt and not recognizing the debt collector suing you. The court can consider this response a non-answer. If you believe you don’t recognize it because of identity theft, you should state that! If you don’t believe you owe the debt, then make the appropriate denials.

- The debt is not on your credit reports. Whether or not the debt is still on your credit reports has no bearing on whether or not a lawsuit can be filed against you for a debt. Sometimes, when a debt has been sold, the original creditor may remove their reporting of that debt from your credit reports and the new owner of the debt may not elect to report the debt to your credit report.

- Unless you know what you are doing, don’t elect for Arbitration. There are plenty of websites out there that say you should file an Answer that demands arbitration of the debt collector’s claim. The idea behind this strategy is that sometimes the debt collector does not want to arbitrate the claim or arbitration is too expensive and they may abandon the claim against you. If you get your request to compel arbitration is granted, and the claim does go to arbitration, would you know what to do? However, in electing for arbitration, you may be making an admission that the underlying debt is yours.

- Violations of the FDCPA unless this is part of a counterclaim. Many people will try to allege that the debt collector did not properly validate a debt or violated the FDCPA as a defense against the lawsuit. These are not defenses. These are affirmative claims that you would have against the debt collector. In other words, you could file a lawsuit against the debt collector or file a counterclaim against the debt collector for those violations of the law but it would not have any direct impact on whether they can prove their lawsuit against you.

Sign, Date, and Give Contact Information

At the bottom of the Answer, you wil need to date it, sign it and put your current mailing address and telephone number. If your contact information changes at any point, you must information the court of this. If you don’t, you could miss a court notice and end up with a judgment entered against you. Even if you file an Answer, not showing up in court when your case is called can result in your Answer being “stricken” and a default judgment entered agaisnt you. Also, don’t forget that you must mail a copy of your Answer to the attorney for the debt collector in addition to filing it with the court.